Is Flight Ticket Cancellation Insurance Really Worth It?

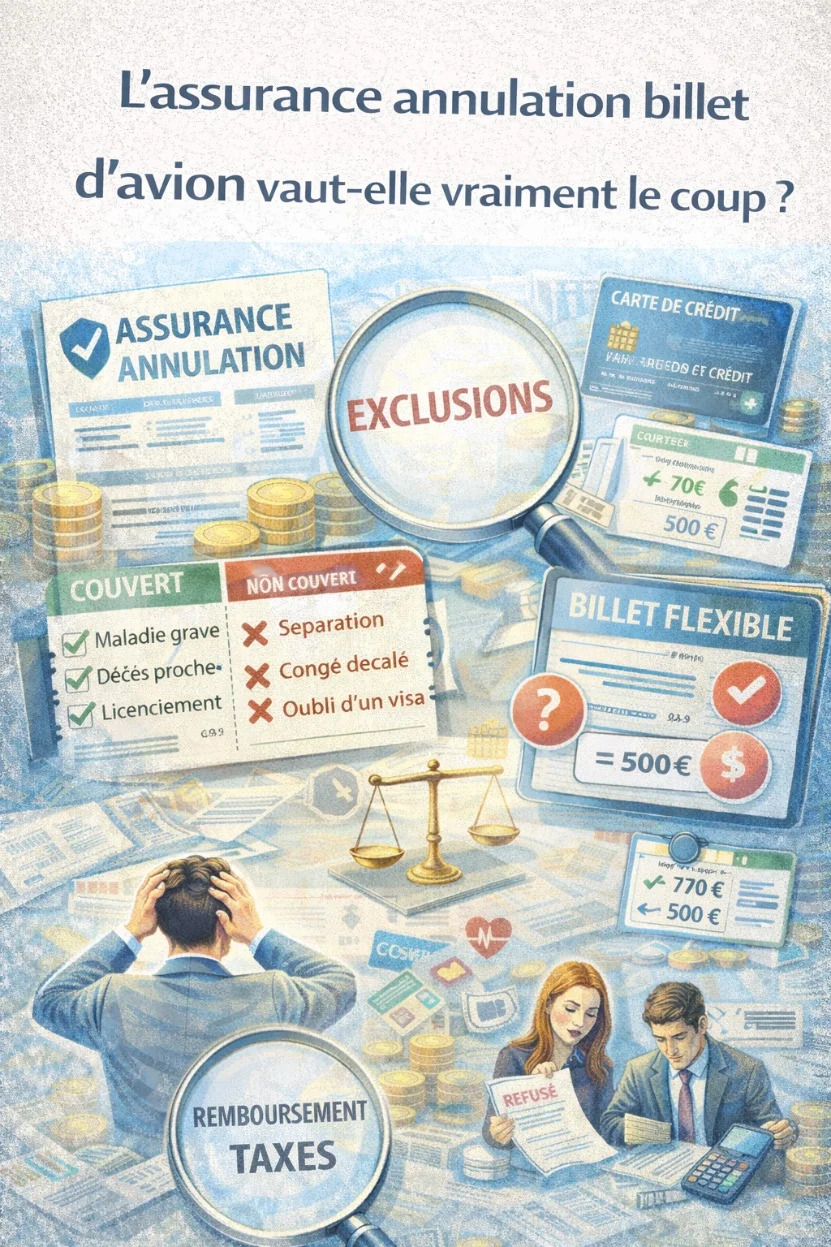

When purchasing a flight ticket, cancellation insurance is almost systematically offered as an option. For a few extra euros, it promises to protect travelers against unforeseen events and avoid total loss of the ticket. On paper, the offer seems reassuring. In reality, coverage is often much more limited than imagined.

Many travelers discover too late that their situation does not match the conditions specified in the insurance policy. So, is cancellation insurance truly useful? In which cases does it work? And most importantly, is it cost-effective compared to existing alternatives?

Understanding How Cancellation Insurance Works

General Principle of Cancellation Insurance

Cancellation insurance theoretically allows reimbursement if an event prevents the traveler from taking their flight. However, this reimbursement is conditional on the occurrence of an event specifically listed in the contract.

Contrary to a widespread belief, cancellation insurance does not cover:

- A simple change of mind

- Poor organization

- An unexpected professional opportunity not specified in the contract

Events Generally Covered

Depending on the policy, the following events are often covered:

- Serious illness or accident of the traveler

- Hospitalization or death of a close relative

- Court or administrative summons

- Economic layoff under specific conditions

These events must be unforeseen, justified, and documented.

Common Exclusions to Know

Uncovered Personal Changes

Many common situations are not covered:

- Separation or divorce

- Change in vacation dates

- Fatigue or stress

- Being late or forgetting

These exclusions represent a large portion of actual cancellation reasons.

Administrative Issues

Cancellation insurance almost always excludes:

- Expired passport

- Visa refusal

- Name error on the ticket

These situations fall under the traveler's responsibility.

How Much Does Cancellation Insurance Cost?

Cost Proportional to Ticket Price

The price of cancellation insurance generally represents:

- Between 3% and 8% of the ticket price

- Sometimes more for long-haul flights

On a €600 ticket, insurance can cost between €30 and €50.

Sometimes a Recurring Cost

When insurance is purchased through a booking platform, it is sometimes:

- Charged per passenger

- Applied to the entire booking

- Non-refundable after a certain deadline

What Is the Real Probability of Benefiting From It?

Few Claims Actually Accepted

In practice, the effective coverage rate is relatively low. Many claims are rejected due to:

- Lack of compliant documentation

- Event not listed in the contract

- Late declaration

Many travelers therefore pay for insurance they will never use.

Often Lengthy and Constraining Procedures

Even when the event is covered, reimbursement requires:

- Precise medical certificates

- Official documents

- Sometimes lengthy processing times

Reimbursement may occur several weeks or even months after the request.

Cancellation Insurance Included with Bank Cards

A Often Overlooked Alternative

Some premium bank cards include travel cancellation insurance. This coverage can be similar to paid insurance, without additional cost.

However, it is subject to:

- Reimbursement caps

- Strict conditions

- The obligation to have paid for the ticket with the relevant card

Limitations of These Integrated Insurances

Insurance linked to bank cards rarely covers:

- All cancellation reasons

- Low-cost tickets at very low prices

- Bookings through certain intermediaries

It is therefore important to check the exact guarantees.

Cancellation Insurance vs Flexible Tickets

Flexible Ticket as an Alternative

In some cases, purchasing a flexible ticket may be more cost-effective than subscribing to cancellation insurance. Flexible tickets allow:

- Free or reduced-fee modifications

- Sometimes partial reimbursement

- Greater freedom in case of unforeseen events

The initial cost is higher, but financial risk is often better controlled.

Cancellation Insurance vs Regulated Resale

An Increasingly Used Alternative

When insurance does not cover cancellation, certain solutions allow regulated resale of the ticket, provided the airline can put it back on sale.

This option sometimes allows recovering:

- A significant portion of the ticket value

- Without depending on a specific cancellation reason

- Without medical or administrative documentation

When Is Cancellation Insurance Relevant?

Cases Where It Can Be Useful

- ✓ Travel with identified medical risk

- ✓ High-value ticket

- ✓ Unique, non-postponable trip

- ✓ Absence of other flexibility solutions

Cases Where It Is Not Cost-Effective

- ✗ Very cheap tickets

- ✗ Easily postponable trips

- ✗ Uncertain personal situations not covered

- ✗ Travelers already having equivalent insurance

Common Traveler Mistakes

- Subscribing to insurance without reading exclusions

- Believing any impediment is covered

- Declaring cancellation too late

- Confusing cancellation insurance with flexible tickets

Conclusion

Flight ticket cancellation insurance can be useful in certain specific cases, but it is far from being a universal solution. Its cost-effectiveness heavily depends on the traveler's profile, ticket price, and actual risks incurred.

Before subscribing, it is essential to compare this option with other alternatives: flexible tickets, existing bank insurance, or regulated resale solutions. An informed decision helps avoid paying for unnecessary or ineffective protection.

Don't pay for limited insurance coverage. ResellMyFlight.com offers a smarter alternative: recover up to 50% of your ticket value through regulated resale—no medical certificates required, no exclusions, just real money back when you can't travel.